Flood damage to residential property turns out to be underestimated: new insights for financial applications

Research by Deltares, the Vrije Universiteit Amsterdam, and Achmea shows that structural damage to residential homes caused by flooding is underestimated in the Dutch Damage and Casualty Model (SSM2023). The damage function from this model is therefore not suitable for use by the financial sector.

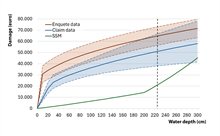

In recent years, the SSM has increasingly been used by the financial sector to calculate structural damage to residential homes. The new study (PDF) shows that this use significantly underestimates damage for water depths of 0 to 2 metres. The financial sector is therefore advised not to use the current version of the structural damage function for single-family homes. In the meantime, two other damage functions for these water depths can be used, as explained in the study.

Study background

After the flooding in Limburg in 2021, a survey was carried out which suggested that structural damage was being significantly underestimated. These findings are now confirmed by an analyses of insurance claims data. The underestimation of damage amounts to a factor of 6–8 at a water depth of 1 metre, and a factor of 3–4 at a water depth of 2 metres. The observations also align better with international literature compared to the low estimates of SSM2023.

Only single-family homes appear to be underestimated

The underestimation concerns the damage function for structural damage to single-family homes. This is only one of the many damage functions in SSM2023. Other land-use types use different damage functions, such as apartments, businesses, infrastructure and agriculture. SSM2023, which forms part of Rijkswaterstaat’s flood risk management toolkit, is intended to calculate total flood damage from large-scale flooding. The deviation identified therefore has only a limited effect on those total-damage calculations. Work is currently under way to determine how these new insights can be incorporated into an update of the SSM.

Within the financial sector, SSM2023 is also used. The structural damage function for single-family homes is often applied on a stand-alone basis, for example, as a building block for setting insurance premiums, making investment decisions, and stress-testing existing mortgage portfolios. In such calculations, the identified underestimation has a substantial impact.

Anyone who wants to avoid underestimating the risk would, for the time being, be better advised to use the structural damage functions presented and explained in the report.